do nonprofits pay taxes on interest income

Yes interest earned on your savings is taxable by law. Contrary to what the anonymous poster to this question stated the surprising answer is yes.

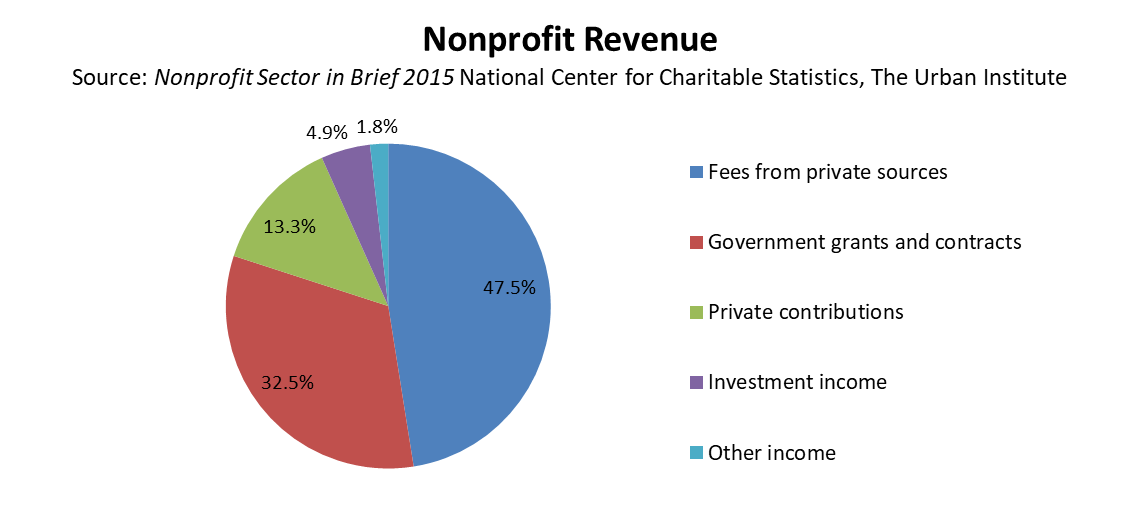

How Do Nonprofits Make Money Making Nonprofits Profitable Jitasa Group

Qualifying nonprofits are exempt from paying federal income tax although they may still have to pay excise taxes income tax on unrelated business activities and employment.

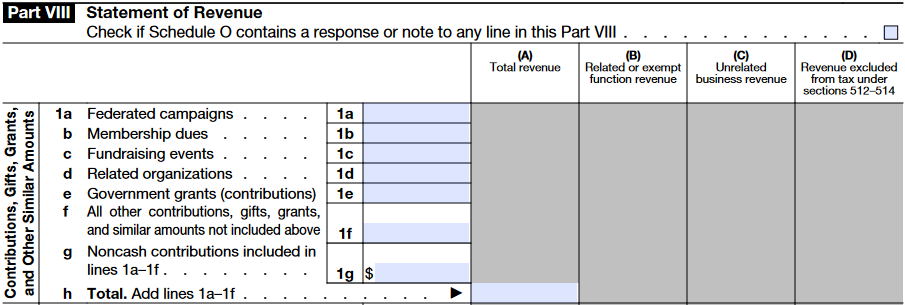

. As long as a. You wont need to pay tax on the amount you deposit into your account because youve already paid income tax on it. Investment income is reported on Line 10 of Form-900 the IRSs informational tax return for nonprofits.

These organizations established by acts of Congress are not subject to these rules and pay very few taxes at all. First and foremost they arent required to pay federal income taxes. Nonprofits are exempt from federal income taxes based on IRS subsection 501c.

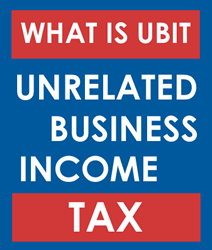

An exempt organization that has 1000 or more of gross income from an unrelated business must file Form 990-T PDF. Nonprofits engage in public or private interests without a goal of. Dividends interest rents annuities and other investment income generally are excluded when calculating UBIT.

Do I pay tax on a unit trust. This is because nonprofits are typically organizations that exist for public and private interest with no interest in making a. The income from unit trusts and OEICs is always taxable regardless of the share class or whether.

Entities organized under Section 501c3 of the Internal Revenue Code are generally exempt from most forms of federal income tax which includes income and capital gains tax. Tax-exempt nonprofits often make money as a result of their activities and use it to cover expenses. An organization must pay estimated tax if it expects its tax.

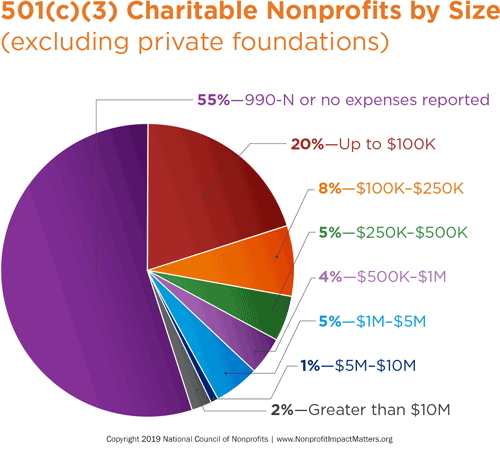

Did you know that sometimes nonprofits must pay income tax. Though an organization is tax exempt its. Nonprofits typically dont have to pay federal income taxes.

Do nonprofits pay taxes. In fact this income can be essential to an organizations survival. Whether a nonprofit corporations interest is subject to income tax depends the incomes source.

Answer 1 of 3. Yes nonprofits must pay federal and state payroll taxes. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions.

Do nonprofits pay payroll taxes. Just because you have a tax-exempt status it does not mean that youre well tax exempt. However this corporate status does not.

Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types of taxes under certain. Nonprofits are exempt from federal income taxes based on IRS. Even then tax-exempt non-profit organizations which do not further qualify as a public charity still have to pay a federal income tax of either 1 or 2 of their investment gains.

I am going to assume you are talking about a US 501c3 approved charity. While most US. In most cases they wont owe income taxes at the state level either as long as they present their IRS letter of.

Youll only pay tax on the interest part of your annuity income. General Rule By and large interest is not subject to income tax for nonprofit corporations. However there are two exceptions where this type of income is taxable.

Your recognition as a 501c3 organization exempts you from federal income tax.

Non Profit Vs Not For Profit Top 6 Best Differences With Infographics

Infinite Giving Nonprofit Investing The Ultimate Guide To Grow Your Giving

Myths About Nonprofits National Council Of Nonprofits

For Nonprofits Montana Department Of Justice

501 C 3 Vs 501 C 6 A Detailed Comparison For Nonprofits

Tax Exemptions For Nonprofit Hospitals A Bad Deal For Taxpayers Stat

Unrelated Business Income Tax Ubit For 501c3 Nonprofits

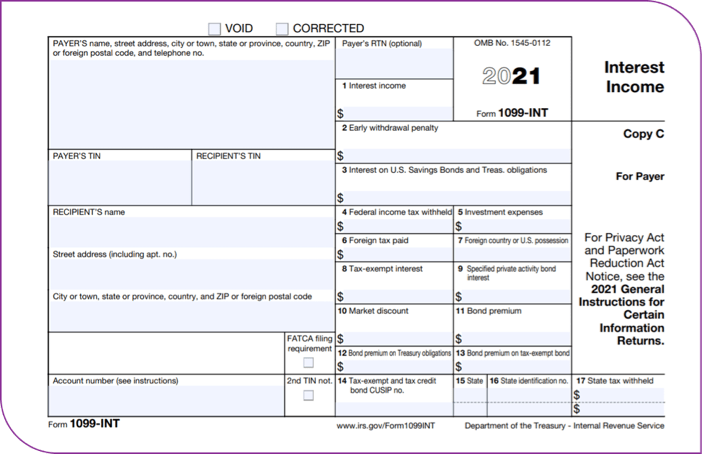

Form 1099 For Nonprofits How And Why To Issue One Jitasa Group

Form 990 For Nonprofits H R Block

Nonprofit Income Streams An Introduction Nonprofit Accounting Academy

How To Prepare A Nonprofit Tax Return Labyrinth Inc

Beginner S Guide To Nonprofit Accounting Netsuite

How To Start A Nonprofit National Council Of Nonprofits

Nonprofit Conflict Of Interest Policy Template Sample For 501c3

Understanding New Revenue Recognition Guidelines For Nonprofits

Covering Nonprofits Questions Answers And Tips For Following The Money

Can A Nonprofit Business Earn Interest On A Checking Account